UK payslip law changed on 6th April 2019, changing how employers issue payslips under the Employment Rights Act 1996 (Itemised Pay Statement) (Amendment) Order 2018.

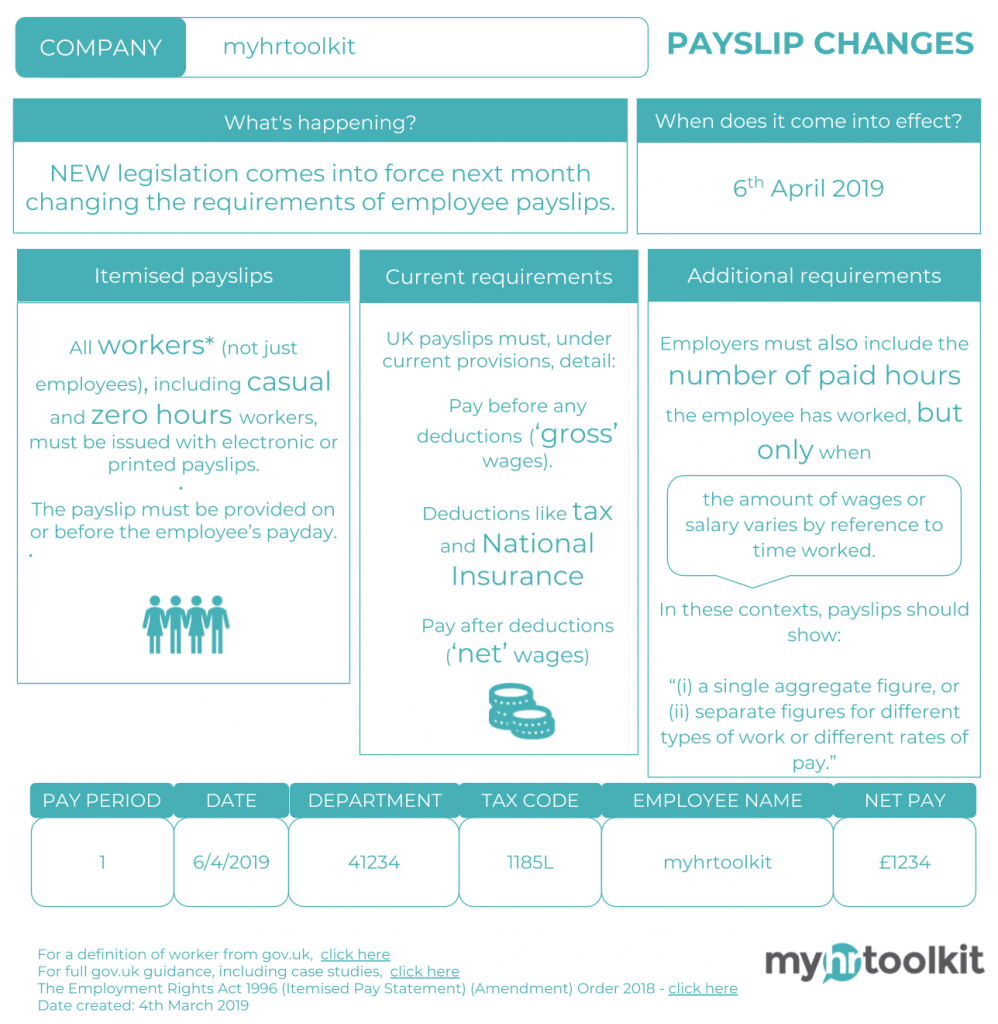

To summarise the changes made to payslip rules and regulations, we’ve put together a handy infographic guide. Check it out below:

Payslip law update overview

In conclusion, employers need to ensure that all workers, not just those with regular hours, receive payslips before or when they are paid. This includes employees, agency workers (who receive payslips from their agency), and workers on variable hours contracts.

Learn more: Holiday management changes for variable hours employees

What information must be shown on a payslip?

Payslips can be issued in paper format or electronically. They must detail the following information:

- Pay before deductions (gross pay)

- Any deductions (such as tax and national insurance)

- Pay after deductions (net pay).

In addition, employers must list the number of paid hours someone works but only when wages/salary varies in relation to amount of time worked.

This important update to UK law will provide employees with greater clarity and transparency over their pay, especially those who work varied hours resulting in pay changes each period. The change also enables any errors to be identified and remedied easily.

Track pay and benefits for your staff easily with our pay and benefits tracking software feature.

Do employers get a penalty for not issuing payslips?

Acas guidance advises employees to approach their line manager or supervisor in the event that they are not receiving payslips or that a payslip they have received contains errors. The next recommended step is a formal grievance procedure, which makes it important for employers to ensure payslips are issued in a timely manner and are accurate.

If there is to be a delay to issuing a payslip, employers should inform staff of the delay as soon as possible and provide an estimated date for when the payslip will be issued. This is also true of any required corrections to issued payslips.

Businesses should ensure that:

- They review and amend the format of their payslips to meet the new requirements

- They adjust payroll processes to collect the new information required

- They include the new information, where applicable, on payslips from 6th April 2019

For full guidance and case studies, visit The Department for Business, Energy and Industrial Strategy (DBEIS)’s website.

Read more from our blog

Money talks: managing and discussing pay with employees

Is your small business prepared for the end of the tax year?

Written by Camille Brouard

Camille is a Senior Marketing Executive for myhrtoolkit who writes on topics including HR technology, workplace culture, leave management, diversity, and mental health at work.

Holiday Planner

Holiday Planner Absence Management

Absence Management Performance Management

Performance Management Staff Management

Staff Management Document Management

Document Management Reporting

Reporting Health and Safety Management

Health and Safety Management Task Management

Task Management Security Centre

Security Centre Self Service

Self Service Mobile

Mobile