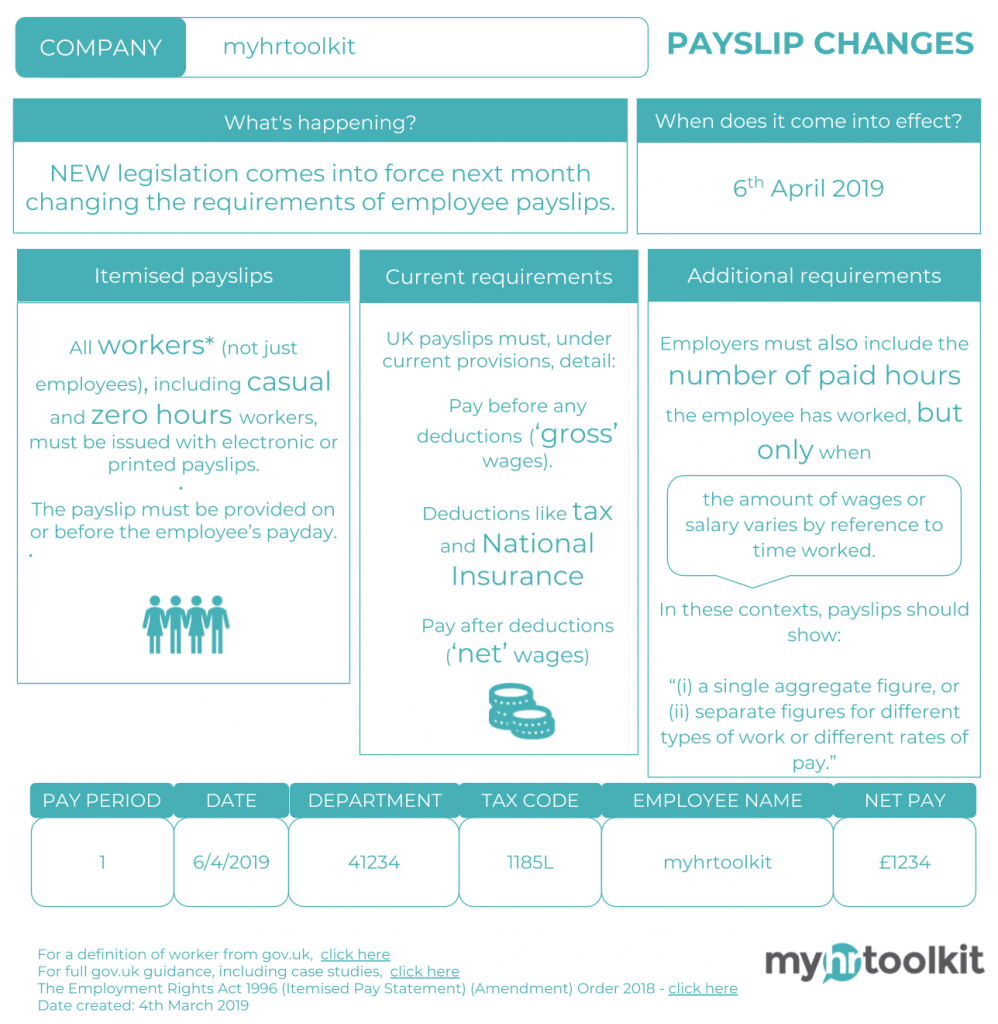

UK payslip law changed on 6th April 2019, changing how employers issue payslips under the Employment Rights Act 1996 (Itemised Pay Statement) (Amendment) Order 2018.

To summarise payslip rules and regulations, we’ve put together a handy infographic guide. Check it out below:

Introduction

Payslips are far more than routine paperwork, they're a fundamental legal requirement, a transparency tool, and a vital way for employees to verify their pay is correct. Since the significant payslip legislation update in April 2019, UK employers have faced enhanced obligations, and recent changes continue to shape the landscape. This guide covers current legal requirements, recent developments, compliance risks, and best practices to help employers stay compliant and build workplace trust.

Current legal requirements

Who must receive a payslip

Under the Employment Rights Act 1996, all employees and workers are entitled to an itemised payslip from their very first payday. This includes:

- Zero-hours contract workers

- Part-time employees

- Agency workers

- Variable-hours workers

- Casual workers

- Those on irregular contracts

Exceptions include genuine self-employed contractors/freelancers (those working outside employment/worker status), certain seafaring roles, those in the police service and armed forces personnel.

When payslips must be provided

Payslips must be given on or before payday in every pay period, whether weekly, fortnightly, monthly, or any other frequency. It is not acceptable to delay payslips after payment due to technical issues or administrative challenges - employers must have contingency procedures in place.

Track pay and benefits for your staff easily with our pay and benefits tracking software feature.

How payslips can be delivered

Payslips can be provided in either:

- Paper format, or

- Electronic format (provided it's secure, accessible, and guarantees privacy)

Mandatory information on payslips

By law, every payslip must include:

Essential information

- Gross pay (before deductions)

- Net pay (after all deductions)

- All deductions, including:

- Statutory deductions (tax, National Insurance)

- Fixed/contractual deductions (pension contributions, union fees, etc.) - Pay period (start and end dates) and payment date

Hours-based pay requirements

Critically important: If pay varies based on time worked, the payslip must show the number of hours worked at the relevant rates during that pay period. This requirement, introduced in April 2019, applies to all variable-hours workers.

Additional Good Practice Information

While not legally required, employers commonly include:

- Tax code and National Insurance number

- Employee number and employer details

- Year-to-date figures for pay and deductions

- Breakdown of different payment components

Recent changes and developments

Holiday pay reforms for irregular workers (April 2024)

One of the most significant recent changes affects irregular-hours and part-year workers. For holiday years beginning on or after 1 April 2024, employers can use "rolled-up" holiday pay, calculated at 12.07% of actual hours worked in a pay period, and this must be shown as a separate payment on the payslip.

Key requirements:

- Rolled-up holiday pay is calculated as 12.07% of the employee's total pay in a pay period and must be shown as a separate item on the payslip. 12.07% is the Statutory amount. This percentage figure will increase if enhanced annual leave is offered.

- This applies only to irregular-hours and part-year workers

- The holiday pay component must be clearly itemised and separated from basic pay

Employment Rights Bill developments

The ongoing Employment Rights Bill is expanding worker protections and may broaden the interpretation of "worker" status, potentially bringing more individuals under payslip protection requirements. Recent developments include extending employment tribunal time limits from three months (minus 1 day from the deduction made) to six months for most claims. This will include unlawful deduction of wages.

Enhanced transparency expectations

Modern workplace culture increasingly demands:

- Digital-first payroll systems with cloud-based electronic payslips as standard

- Employee empowerment through clear, accessible pay information

- Financial wellbeing support via comprehensive payslip clarity

- Greater expectations for pay transparency and fairness

Compliance risks and penalties

Failing to meet payslip requirements can result in:

Legal consequences

- Employment tribunal claims, particularly for unlawful deductions where deductions aren't properly documented or authorised

- Compensation orders potentially requiring payment equal to incorrect deductions for up to 13 weeks

- Regulatory scrutiny from HMRC and National Minimum Wage enforcement teams

Business impact

- Reputational damage and loss of employee trust

- Formal grievances and workplace disputes

- Increased administrative burden from error corrections

Best practices for compliance

Audit your payroll system

- Ensure your payroll software includes all required elements

- Verify that variable-hours workers' information is captured correctly

- Check that holiday pay is properly calculated and itemised for irregular workers

- Test electronic payslip accessibility and security

Update policies and contracts

- Review employment contracts and staff handbooks to reflect current obligations

- Clearly define worker status classifications

- Explain deduction types and authorisation processes

- Include procedures for payslip queries and corrections

Train your team

- Ensure payroll and HR staff understand all legal requirements

- Provide guidance on dealing with different worker classifications

- Train teams on deadline compliance (on or before payday)

- Establish clear error correction procedures

Ensure accessibility and transparency

- Make payslips easily accessible in chosen format

- Provide employee guidance on interpreting payslips

- Establish clear channels for employees to raise questions

- Maintain secure systems for electronic payslip delivery

Implement contingency plans

- Develop procedures for handling payslip delays or technical issues

- Create clear error correction processes for past and future payslips

- Establish proactive communication protocols for any issues

Stay updated on legal changes

- Monitor developments in the Employment Rights Bill

- Subscribe to employment law updates

- Review payslip practices regularly

- Consider professional legal advice for complex situations

Quick compliance checklist

- All employees and workers receive payslips on or before payday

- Each payslip shows gross pay, net pay, and all deductions

- Hours worked are included for all time-based variable pay

- Holiday pay is properly calculated and itemised (especially for irregular workers using the 12.07% method)

- Worker/employee status is correctly identified

- Payslips are accessible in appropriate format (paper or secure electronic)

- Contracts and policies reflect current legal requirements

- Staff are trained on payslip obligations and procedures

Conclusion

UK payslip law represents a well-established but evolving area of employment regulation. While the core requirements from the 2019 changes remain unchanged, recent developments around holiday pay for irregular workers and ongoing Employment Rights Bill proposals continue to shape employer obligations.

Getting payslips right is fundamental, not only to avoid legal risks, but to build trust, transparency, and fairness in the workplace. In an era of increased expectations around employee rights and financial wellbeing, accurate and timely payslips are essential for maintaining positive employment relationships and demonstrating commitment to compliance and employee care.

By implementing robust payroll processes, staying informed of legal changes, and maintaining clear communication with employees, employers can ensure they meet their obligations while supporting a positive workplace culture built on trust and transparency.

For full guidance and case studies, visit The Department for Business, Energy and Industrial Strategy (DBEIS)’s website.

Disclaimer: This guide provides general information about UK employment law as of 2025. It should not be considered as legal advice. For specific situations, consult with qualified employment law professionals.

Read more from our blog

Money talks: managing and discussing pay with employees

Is your small business prepared for the end of the tax year?

Written by Camille Brouard

Camille is a Senior Marketing Executive for myhrtoolkit who writes on topics including HR technology, workplace culture, leave management, diversity, and mental health at work.

Holiday Planner

Holiday Planner Absence Management

Absence Management Performance Management

Performance Management Staff Management

Staff Management Document Management

Document Management Reporting

Reporting Health and Safety Management

Health and Safety Management Task Management

Task Management Security Centre

Security Centre Self Service

Self Service Mobile

Mobile